Become a CeFT®

Core Training 2024 - Register Today for Spring

3rd Wednesday of each month, April 17th, 2024

4:30 - 6* pm IST (Call 1 is 2 hrs)

Learn the fundamentals of Financial Transitions Planning

What is Core Training?

The Core is shorthand for our yearlong program in Financial Transitions Planning.

This includes insight into the unique needs of client-in-transition, such as how to identify and work through the behavioral and cognitive struggles that lead to problems during major life transitions. From struggles with communication, decision-making, managing expectations, and even implementation, we’ve got science-backed tools and processes.

Just as important, we will show you how to identify when a client is in a state of flow and provide you with tools to further enhance that flow.

In this ADVANCED Training, you will learn:

- A unique perspective on transitions informed by psychology, sociology, neuroscience and adaptive leadership.

- In-depth training in the stages of transition and the behavior and thought processes of clients in transition.

- The support of study groups and mentors, some of whom have been members of this community for nearly two decades.

- Two coaching calls with FTI faculty.

- Nine co-branded tools for you to use with your clients.

- Invitations to members-only events.

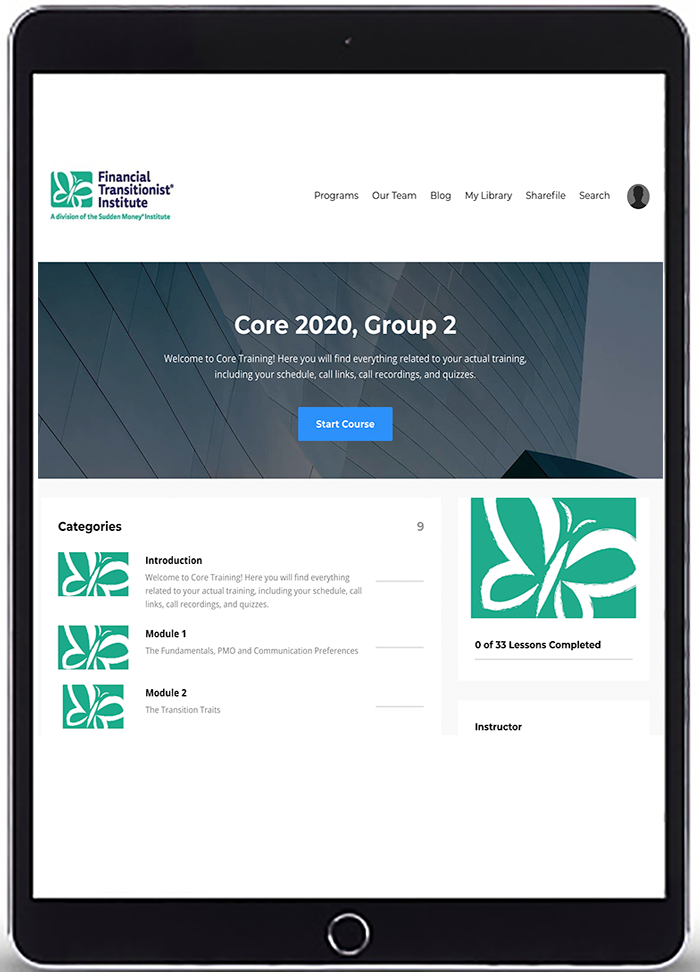

How does Core Training Work?

It is one year of on-demand training, live “experience” calls, intensive casework, role play, and in-person collaboration with the most engaging community of forward-thinking professionals in our industry.

Is Core Training Right for Me?

Passionate professionals with at least five years of face-to-face client contact who you want to learn how to skillfully work with clients during chaotic times filled with uncertainty. Although practitioners from various fields are welcome to apply, please know that the curriculum assumes a working knowledge of comprehensive financial planning, therefore solid technical skills are a prerequisite.

*The CeFT® is a level-up designation. This means that although anyone with at least five years of face-to-face client contact can apply to Core and attend the full year of training in Financial Transitions Planning, only those with a CDFA, CFP®, CFA®, ChFC, CIMA®, CPA/PFS, CPWA, or CWS may sit for certification.

Your Investment:

*There are discounts for teams and there is corporate pricing, as well.

📧 Email info@financialtransitionist.com for details.

Members Testimonials

What Our Members Say About Core Training:

Ross Marino, CFP®, ChFC®, CPFA, CeFT®

Founder of Transitus Wealth Partners

"The CeFT® tools are like the Rosetta Stone for financial planning. For years, I’ve watched clients struggle to make decisions during life’s most challenging events. Sometimes, the right decision seems obvious to everyone but the client. Why is that? Understanding how people react during times of transition is the key to understanding."

Lisa A.K. Kirchenbauer, CFP®, RLP®, CeFT®

Founder & President of Omega Wealth Management

"The CeFT training that not only I, but my colleagues at Omega have received helps us work more collaboratively together while bringing in the 21st-century planners communication and relationship skills that clients are looking for and now the CFP Board recognizes are needed for the future."

Cicily Maton, CFP®, CeFT®

Sr. Financial Planner, The Planning Center

"I have used these tools and processes for nearly 20 years. Each time, they help me create a meaningful and sometimes profoundly important client experience that might not have happened without the tools and training."

FAQ's

Am I a CeFT® once I complete the training?

What does completing the training course mean?

What's the payment policy after I join?

*The CeFT® is a level-up designation. This means that although anyone with at least five years of face-to-face client contact can apply to Core and attend the full year of training in Financial Transitions Planning, only those with a CDFA, CFP®, CFA®, ChFC, CIMA®, CPA/PFS, CPWA, or CWS may sit for certification.